Sound Business Sense

In the last Sound Business Sense, the discussion centered on the business cycles that are part of any “free market” system. Businesses thrive on the reliable prediction of revenues and earnings for continued success, possible expansion, and startup ventures; however, the onset of the COVID crisis disrupted all free-market economies, so there were no longer stable prediction capabilities. These major economic fluctuations have not been seen in over a hundred years.

Attempts to predict these business cycles use Economic Indicators, which are calculations on various economic factors commonly used to forecast future and current performance as well as the actual performance. Leading indicators point toward possible future conditions, whereas lagging indicators confirm economic, or market shifts already in motion, and coincident indicators occur in real time and clarify actual economic performance. While these indicators are always a bit debatable, they remain a barometer into the economic future, current factors, and the actual consequence of economic activity. Generally, the relative importance of each specific indicator varies according to the country, governmental data manipulation, business culture and now, a country’s post-pandemic recovery.

Picardo (2023) presents ten economic indicators used in Canada to analyze the world’s eighth-largest economy. Of these ten economic indicators, seven show key aspects of Canada's economy: consumer spending, housing, manufacturing, employment, inflation, external trade, and economic growth, and when analyzed together, they provide a comprehensive picture of the state of the Canadian economy. Since space limitations requires simply demonstrating the utility of these indicators, Dwyer (2024) offers the remaining three as the most important Canadian indicators: Consumer Price Index (CPI), a lagging indicator; Gross Domestic Product (GDP), a lagging indicator; and Unemployment, a coincident indicator. A major leading indicator, Retail Sales, will also be presented to offer the futuristic perspective.

Retail Sales

Retail sales are a leading economic metric that tracks consumer demand for finished goods. Consumer spending is considered the primary driver of Canada's economic growth, meaning a significant portion of the nation's economic activity is directly related to what individuals purchase. This figure is a very important data set as it is a key report presented each month by Statistics Canada that is an indicator for the direction of the Canadian economy. Consumer purchases of durable and non-durable goods are compiled in a report. The retail sales report helps analysts and investors gauge the economy's health and any possible inflationary pressures. An accurate measure of retail sales is vital for gauging the economic health of Canada as consumer spending accounts for 60% of the Canadian gross domestic product.

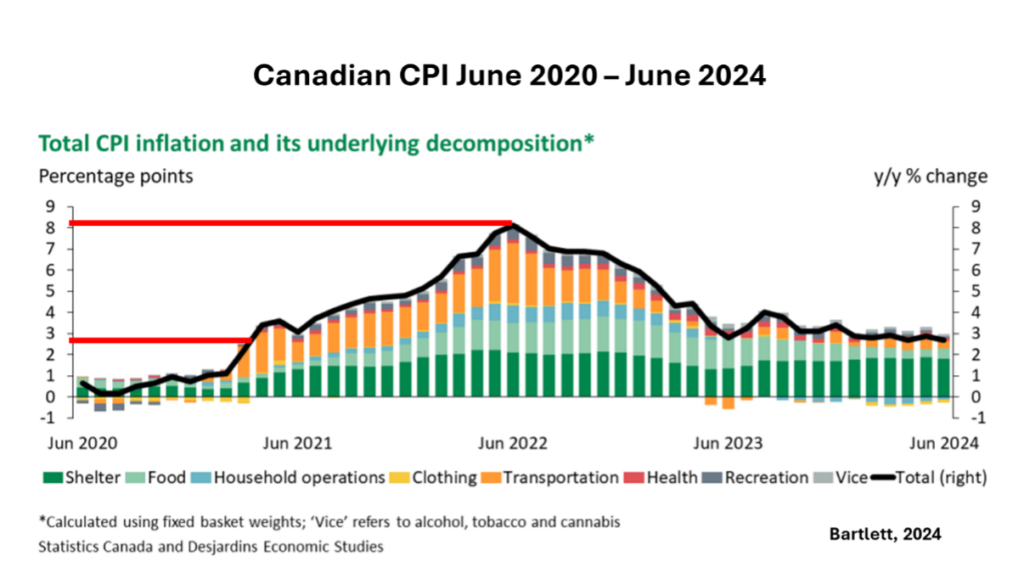

Consumer Price Index (CPI)

The CPI is a leading economic indicator also offered by Statistics Canada that measures inflation rate. The index demonstrates how urban consumers' living costs change over time. It compares how a fixed basket of goods and services purchased fluctuates. The report demonstrates the change in CPI monthly, over the preceding 12 months, and on an overall basis, excluding food and energy prices. It is a major factor indicating whether prices for goods and services have increased, decreased or remained the same. If the costs of these goods and services are higher, then inflation exists and interest rates or other adjustments are necessary to maintain stability. Bartlett’s chart below indicates that, although inflation was over 8% in June of 2020, as of June 2024 it was down to a more acceptable level of about 2.8%. With inflation under control, economically, it would be a better time to consider expansion or a start-up as interest rates would be more favorable and loans would be easier to obtain.

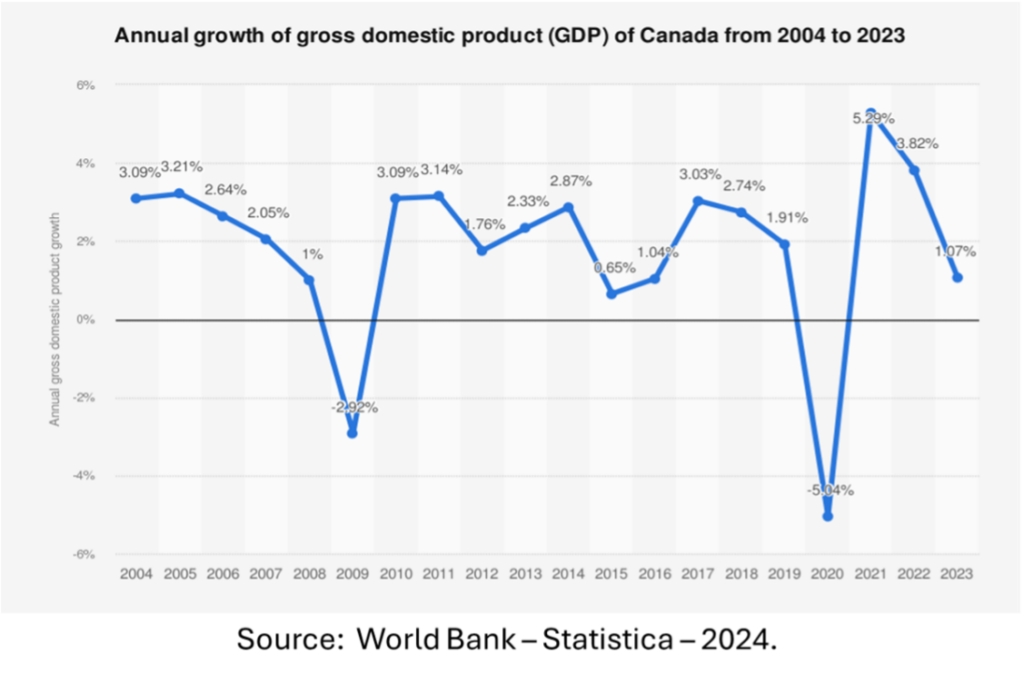

Gross Domestic Product Growth (GDP)

Statistics Canada also publishes growth statistics or GDP on the Canadian economy monthly and quarterly. GDP reflects past economic activity and does not necessarily predict future trends, as it is based on data that has already occurred. As a lagging indicator, the GDP report shows the real gross domestic product (GDP) for the overall economy and may, for some purposes, be broken down by industry. Real Gross Domestic Product (GDP) is an inflation-adjusted measure that reflects the value of all goods and services produced by an economy each year. Real GDP is expressed in base-year prices. Put simply, real GDP measures the total economic output of a country, by percentage increase of the previous year. It reflects past economic activity and does not necessarily predict future trends, as it is based on data that has already occurred. It does, however, compare last year’s performance to the current year’s, offering information about whether business will likely be the same, better or worse. Canada was the eighth-largest economy measured by gross domestic product (GDP) in 2023. Below is the Canadian Real Gross Domestic Product for the years 2004 – 2023.

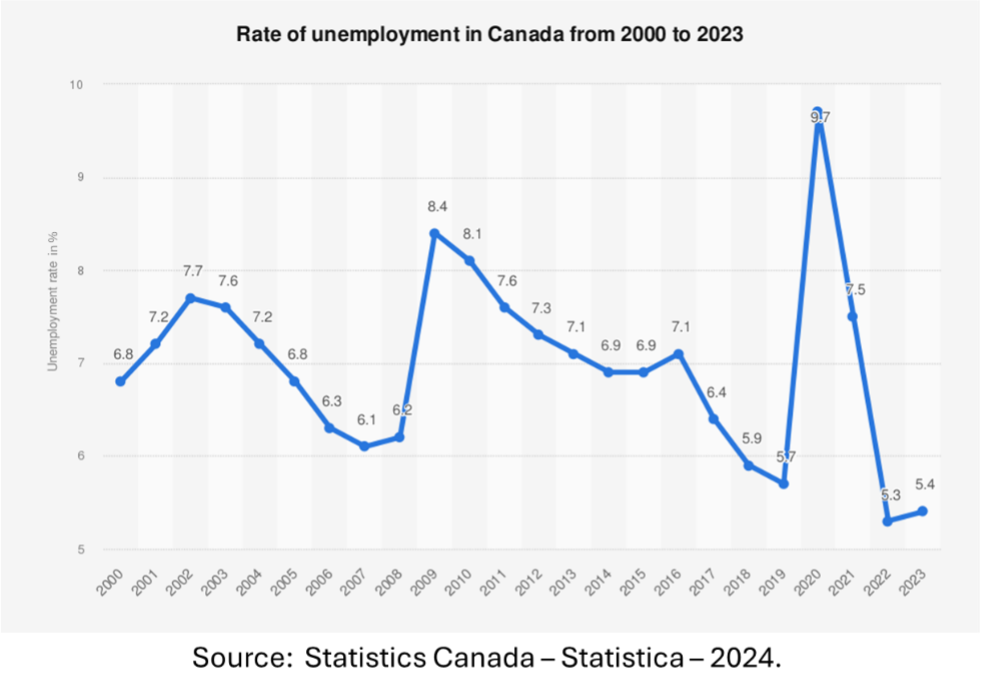

Unemployment

Coincident economic indicators are generally considered the result of how an economy has performed and whether it is moving roughly in line with other economic activity, like Retail Sales, CPI, and GDP. The difference, however, is that rather than predicting future changes, these data result from current economic performance; therefore, a rise in the percentage of unemployed individuals indicates a current economic slowdown. For example, if retail sales and other leading indicators are down, the lagging indicators are suggesting a higher CPI and a lower GDP, then it is likely that an unemployment increase will coincident to the downward trends as companies will need less workers to produce less product than that being demanded.

While these are only a sample of economic indicators, it presents their importance regarding business operations. There are many more of these indicators, many of which are unique to Canada and others that are used worldwide. A detailed study of economic indicators is essential to making sound business decisions that result in a successful practice.

We will discuss currency (Euro v Swiss France; Canadian v US dollars) in our next issue of Sound Business Sense!

References

- Bartlett, R. (2024). Canada: Slower Inflation in June All but Guarantees a July Rate Cut, Desjardins, Quebec city, Quebec, Canada. Retrieved December 16, 2024.

- Dwyer, J. (2024). Tackling Canada’s Economic Productivity Challenges. Canadian Institute, Wilson center, Washington, DC, USA. Retrieved December 16, 2024.

- IBIS World (2024). Consumer Spending 1980-2024. Business Environment Profiles – Canada, IBIS World, Canada. Retrieved December 16, 2024.

- Picardo, E. (2023). 10 Economic Indicators for Canada. Investopedia. Retrieved December 10, 2024.

- World Bank – Statistica (2024). Annual growth of gross domestic product (GDP) of Canada from 2004 to 2023. Statistica. Retrieved December 16, 2024.