Sound Business Sense

Global Edge (2024) describes Canada’s economy as a market economic system in which the prices of goods and services are determined in a free price system. Canada and the United States are both great examples of market-driven economies where the amount of a product that consumers demand usually indicates to managers within an industry, how much of that product is to be manufactured and distributed for what price to the marketplace.

Economists make the assumption that market forces, such as supply and demand, are the best determinants of what is right for a nation’s well-being. In contrast, the opposite is a Command Economy where most markets, from hearing aids to toilet paper, are controlled by a central committee within the communist party. Since command economies cannot adjust fast enough according to the demand, there are often shortages of various products. These product shortages create huge black markets that meet the consumers’ product demands.

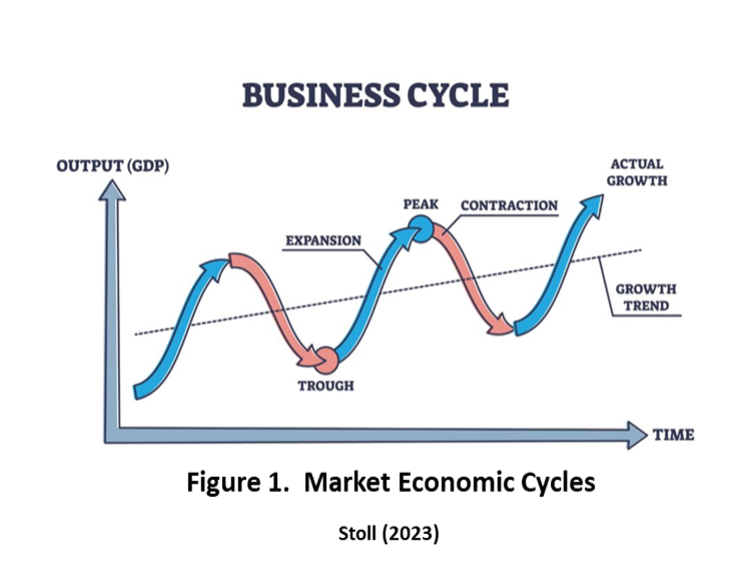

As previously presented, most other “free” markets are mixed economies and, to some degree, controlled by their respective governments. For example, most governments restrict the sale of alcohol to minors, thus limiting the free market. The same limitations apply to medications that must be prescribed by a licensed physician and dispensed by a licensed pharmacist. Like most Western economies, these markets are generally free markets with some government intervention regulating certain products and services, so they are technically referred to as Hybrid Markets. These hybrid market economies are subject to natural economic cycles consisting of irregular expansion and contraction patterns. These business cycles, on average, last about five years and pass through four specific stages, expansion or recovery, peak, contraction or recession, and trough; each of which can vary in length and intensity with many lasting only a few years. These economic expansions and contractions (Figure 1) are part of a continuous economic fluctuation that creates periods of economic prosperity and austerity.

Expansion Business Cycle

During an economic expansion, the economy is growing, and as it moves out of recession, money is cheap to borrow, businesses build up inventories again and consumers start spending. When a country’s overall product rises, it is characterized by:

- Increased output: The overall production of goods and services in the economy rises.

- Lower unemployment: As businesses expand, more workers are hired, leading to declining unemployment rates.

- Higher consumer spending: With increased confidence and disposable income, consumers tend to spend more on goods and services.

- Increased business investment: Businesses are more likely to invest in new projects, equipment, and research and development.

- Rising stock market: Equity markets usually perform well during an economic expansion.

- Low interest rates: Interest rates tend to be lower during expansionary periods, making borrowing easier for businesses and consumers.

The Peak

The peak of a business cycle marks the highest point of economic activity in an expansion phase, signifying the transition from continuingly growing stronger into a contraction. Essentially, it is the point where the economy reaches its maximum output before beginning to decline. After this peak in the economic output reduction in economic indicators are observed that leading to the contractionary phase of the cycle it will stabilize for a short time, called a peak, before it reverses direction.

Contraction Business Cycle

Contraction is the business cycle phase where the economy is in decline. A contraction generally occurs after the business cycle peaks before it becomes a trough. According to most economists, when a country’s overall product output has declined for two consecutive quarters or more (Tardi, 2024). This period of economic contraction is called a recession. For many individuals, a recessionary economy is a precursor to economic hardship. As the economy plunges into a recession, there are indicators of unemployment and uncertainty for workers and consumers. Although no economic contraction lasts forever, assessing just how long a downtrend will continue before it reverses is difficult. If it lasts longer than 18 months, it may be called a depression.

A contraction refers to an economy in decline.

- A contraction is measured by a decrease in a country’s overall capability to produce product,s which is the most-watched indicator of economic activity.

- As employment decreases, companies hire fewer workers and may lay off some existing workers.

A number of events, including financial crises, trade shocks, supply shocks, economic bubbles, or natural disasters can trigger these economic contractions. They may also be a factor created by political economic mistakes.

The Trough

The trough of the cycle is reached when the economy hits a low point, with supply and demand hitting bottom before recovery. The low point in the cycle represents a painful moment for the economy, with a widespread negative impact from stagnating consumer spending and lower incomes.

Since the economy's condition affects so much of everyday life for the citizens of any country, Collin (2024) describes general sets of business cycle indicators used by economists to analyze the cycle, possibly predicting the economy's future. These business cycle descriptions, usually called economic indicators, are used to analyze where the economy is moving within the cycle, the current condition of the economy, and the overall state of the either expanding or contracting economy. These economic indicators fall into three general categories:

- Leading indicators are used to help predict the future course of an economy, generally short-term, which is 6–12 months ahead or up to 12–24 months in the longer term. The turning points of the business cycle are an indicator that tends to move up or move down several months before the economy itself moves. These indicators provide valuable early or advance signals of the likely direction or course of the economy.

- Lagging Indicators are those that track changes in the economy but, typically, do not change direction until a few quarters after the economy either moves into or out of a contraction period.

- Coincident Indicators are not so useful for predicting an economy's future course but provide valuable insights into the condition of an economy's current or prevailing state.

These indicators will be our next topic of discussion at Sound Business Sense!

References

- Globaledge (2024). Canada: Introduction. Global Edge. Retrieved October 7, 2024, from https://globaledge.msu.edu/countries/canada

- Reserve Bank of Australia (2024). The Business Cycle. Retrieved October 7, 2024, from https://www.rba.gov.au/education/resources/presentations/pdf/the-business-cycle.pdf

- Stoll, R. (2023). Understanding Stock Market & Economic Cycles. Financial Design Studio. Retrieved October 7, 2024, from https://financialdesignstudio.com/understanding-stock-market-and-economic-cycles/

- Tardi, C. (2024). Contraction: Definition, How It Works, Examples, and Stages. Investopedia, Retrieved October 7, 2024 from https://www.investopedia.com/terms/c/contraction.asp#:~:text=Contraction%2C%20in%20economics%2C%20refers%20to,stock%20market%20indexes%20trend%20downward