Hearing Aids – Age and Type from MarkeTrak 9

Trends

Wayne Staab, PhD (Trends) was one of the first audiologists to work with manufacturers back in the 1970s and has a wealth of both historical and current knowledge. His perspectives are balanced and always well thought out.

MarkeTrak 9 (MT9) was provided to Hearing Industry Association (HIA) members in early April.

This confidential 183-page report, titled MarkeTrak 9: A New Baseline, was conducted as an online survey using a large, multi-source sample of hearing aid owners and non-owners. Preliminary data is available at: http://hearinghealthmatters.org/hearingnewswatch/2015/hhtm-exclusive-findings-from-new-marketrak-study-show-greater-hearing-aid-use-satisfaction/.

Unlike previous MarkeTrak surveys, MT9 was designed to form a new baseline of data to provide a solid backdrop on the hearing aid market, and also to serve as a reference and starting point for future analyses and publications, as well as follow-up research.

Hearing Aid Trends

This post provides a preliminary review of one small data set sample from the MT9 Report. This relates to current average hearing aid age, the types of hearing aids currently being worn, and the hearing-aid-to-ear coupling.

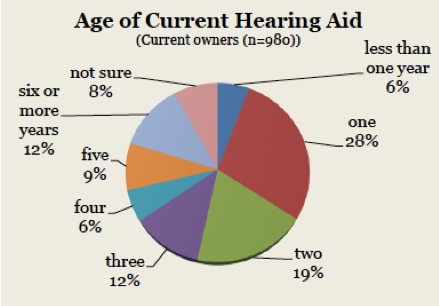

Age of Current Hearing Aids

The average age of currently owned hearing aids is 3.3 years (Figure 1). This compares to 4.1 years in 2008 (MT VIII), and to 4.5 years in 2004 (MT VII). This would seem to suggest a trend toward more frequent replacement of hearing aids. An initial assumption might be that this trend is suspected to be related to improved design and performance features. However, because of the survey method used between MT9 and previous MarkeTrak reports, comparisons are of doubtful validity, and the apparent 5.4% increase in the percentage of hearing aid users between 2008 and 2014 should be used cautiously. Regardless, these online survey data serve as a new baseline for future comparisons.

Figure 1. Average age of aids by users is 3.3 years (duplicated from the MT9 Report).

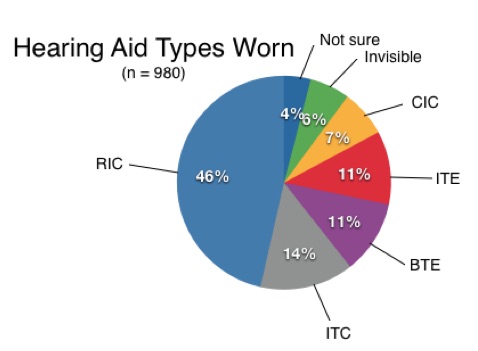

Hearing Aid Types

The most common type of hearing aids owned as reported in this survey are RICs, followed by ITCs, BTEs and ITEs (Figure 2). The disruptive technology of the RIC (receiver-in-the-canal) hearing aid continues, showing it to represent the highest percentage of hearing aids being worn, at 46%. This is followed in ownership by ITC (in-the-canal) hearing aids at 14%, and closely behind this type, evenly by BTE (behind-the-ear), and ITE (in-the-ear) units at 11%. Other types have a smaller percentage of ownership as shown in the graph.

Figure 2. Hearing aid type worn. Key: RIC (receiver-in-the-canal), ITC (in-the-canal), BTE (behind-the-ear), ITE (in-the-ear), CIC (completely-in-canal), invisible (not seen when inserted). Charted using MT9 data.

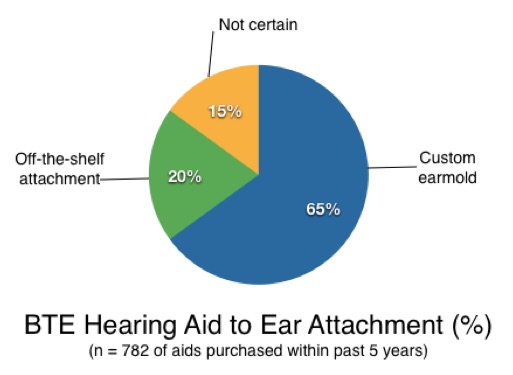

BTE Hearing Aid to Ear Coupling

Owners of BTE hearing aids were asked to classify “the part of the hearing aid(s) that connects to the tube that fits inside the ear.” Their responses are provided in Figure 3. A custom earmold was described to hearing aid owners as one specifically created to securely fit the shape and size of the ear. An off-the-shelf was described as a silicon or sponge-like dome. These percentages should be analyzed more specifically because they seem to be inconsistent with Figure 2. For example, Figure 2 shows about 559 total BTE instruments (RIC plus BTE). If the percentages of Figure 3 are correct, this suggests that 363 of 559 couplers are custom-molded, and that just 112 are “off-the-shelf.” Custom earmolds for the BTE category instruments (108 units) are expected. However, this would still mean that the majority of the 451 RIC instruments (46%) are fitted with custom earmolds. Of course, this is probable. Still, one has to wonder if “custom made to fit the shape and size of the ear” could not have been interpreted by owners to relate to the selection of the correct dome size and style. This will require some further exploration, data not immediately available.

Figure 3. Type of “earmold” used to deliver the sound from the BTE (behind-the-ear) hearing aid to the ear. Charted using MT9 data.

Reference

MarkeTrak 9: A New Baseline. Estimating hearing loss and adoption rates and exploring key aspects of the patient journey, Final Report, March 2014, Hearing Industries Association.